Would you like to invest in sustainable and ethical funds, but aren't sure you can trust them? This article is for you.

Why choose a durable bottom? What are the selection criteria? And many other points will be covered in this article.

1. Why a durable background?

2. What are the different selection criteria?

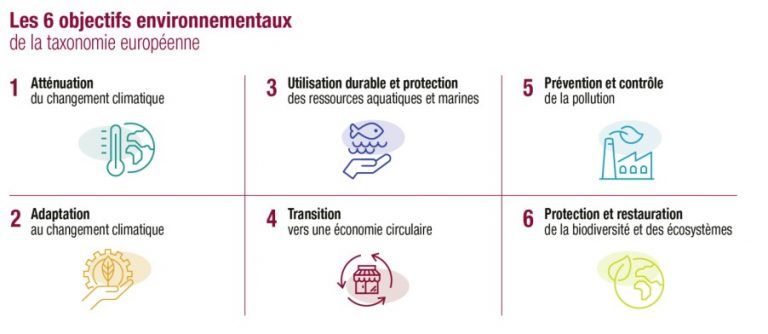

The aim of the new regulations is to direct as much capital as possible towards sustainable investments, with as much transparency as possible. And good news! As an individual, you also have access to these new investments. In fact, your savings can be invested in financial funds that meet the taxonomy's criteria.

To do so, 3 categories of investment funds have been identified by the taxonomy according to their requirements:

- Article 6 : includes all funds

- Article 8light green« funds: meet classic ESG (Environmental, Social and Governance) criteria.

- Article 9dark green« funds: sector and thematic funds invest in companies that have a strong positive impact on climate and social objectives.

3. Would you like to invest in one or more sustainable funds?

4. High-performance financial investments

In the wake of the various crises we have experienced (Covid, war in Ukraine), it seems that SRI funds have held up better and are therefore increasingly popular.

What's more, they now rival «classic» or traditional funds in terms of performance, with equivalent or even superior returns depending on the field.