When it comes to private health insurance (PKV) in Germany, you hear it all. Some present it as much cheaper, others as much more expensive. Almost everyone agrees that private health insurance offers better benefits, but opinions differ on the rest.

👉 Should we go there or run away from it at all costs?

- We often hear that you can't go back to public insurance once you've switched to private. Yet others tell of being forced to leave the PKV and return to the GKV (the public system)...

- What's more, premiums would skyrocket with age. Yet the law prohibits insurers from increasing premiums simply because of age - or even because of health!

So how do you find your way around as an expatriate in Germany? In this article, we'll simply explain the differences between the two systems - in terms of prices and benefits - and what's involved if you switch, to help you choose what's best for you.

1. How much does public and private insurance cost in Germany?

- Before choosing between public health insurance (GKV) and private health insurance (PKV), it's essential to understand how contributions work and what they might mean for your current situation. But it's just as important to think ahead:

- Your situation may change - marriage, children, change of professional status - and these changes will have a direct impact on your contributions and the overall cost of your health cover.

- Finally, bear in mind that contributions change over time, in both the private and public sectors.

How are GKV contributions calculated?

- Income-based contributions :

- 21.3% of gross salary (20.7% if you have children)

- The contribution is capped: above a certain income, the contribution no longer increases (2025 cap: ~ €66,150 gross/year or €5,512.5/month).

- Result: if you earn more than €5512.5 gross per month, you pay €1,174 in insurance (€1,141 if you have children).

- Employer pays half the contribution

- Good to know: children and spouse - if you're married AND he/she doesn't work - are insured free of charge with you.

How the PKV (private health insurance) contribution is calculated

- Premiums based on the individual (age, state of health, coverage chosen), not on income.

- Prices vary widely: can start at €300/month for a young employee in good health.

- No free membership for children or spouse → each member must be insured separately.

- The employer also pays half the contribution, including that of the children or spouse, up to a maximum of what it would have paid if you were insured in the public sector.

- Get your personalized quote

Concrete examples and comprehensive cost analysis between GKV and PKV

To get a better idea of price differences according to age and family situation, take a look at our video explanatory.

In this video, we take a closer look at :

- Public and private insurance costs by age

- Effects on spouses and children in the event of a change of situation

- We advise you not to make your choice solely on the basis of your current situation, but also to take into account potential changes in your situation, especially as returning to the public sector after a spell in the private sector can be complicated.

Note that today's prices may vary tomorrow. In the private and public sectors alike.

Evolution of contributions over time

Contributions to the PKV may increase over time, but not for the reasons we often think.

- Neither age nor state of health can justify an increase. In Germany, the law prohibits a private insurance company from increasing a policyholder's rates simply because he or she is getting older or sicker. When an increase is decided, it is applied uniformly to all policyholders under the same contract: whether they are 30 or 60, in perfect health or suffering from a pathology. Price increases are due to the rising costs of the healthcare system.

- What naturally changes with age, however, are medical needs. A policyholder who has opted for a very basic plan at 30 may want to add benefits (dental, hospitalization, glasses, etc.) at 55. And that can be costly: the later you enter the market with specific needs, the higher the premium. Hence the importance of choosing good coverage from the outset, even if you don't «use» it immediately. (By the way, some insurers offer large premium refunds as long as you don't send them a bill, which can be a good compromise!)

Germany's public system (GKV) is also experiencing regular increases due to healthcare cost inflation.

- By 2025, the contribution ceiling (Beitragsbemessungsgrenze) has increased by +6.5 % and your contributions by the same amount!

- Public funds can also increase their additional contribution rate (Zusatzbeitrag), which they do on a regular basis.

- Finally, the GKV has a lever that the PKV does not: the limitation of benefits. Certain expenses that used to be reimbursed are no longer reimbursed (e.g. eyeglasses). This is a way for the funds to control their costs without directly affecting contributions.

After this purely cost-based comparison, let's now turn to the differences in benefits between public and private insurance. These are just as important to consider, as they too have a direct financial impact on your healthcare budget.

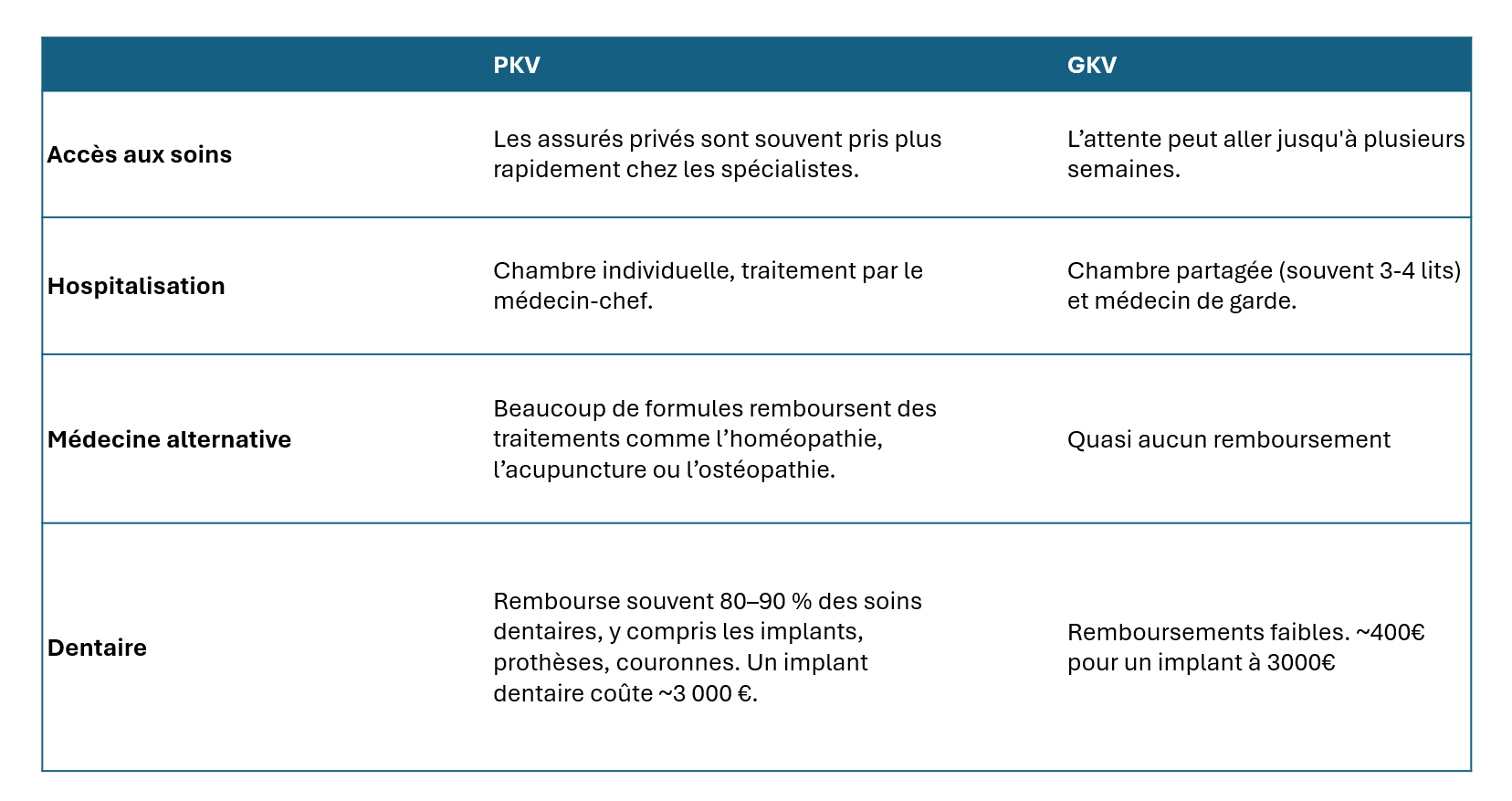

2. What are the differences in benefits between public and private insurance?

With public health insurance, you can take out a Zusatzversicherung (supplementary health insurance) to avoid having to pay too much out of your own pocket. However, the cost is entirely your own, with no contribution from your employer.

The study of prices and services, taking into account your current situation and potential changes, is fundamental, because as you know: you're making a decision for the long term... switching from one system to another doesn't just depend on your will: it's a strictly controlled process.

3. Going from public to private... and vice versa?

In Germany, the transition between public health insurance (Gesetzliche Krankenversicherung - GKV) and private health insurance (Private Krankenversicherung - PKV) is strictly regulated.

From public to private

This is possible in two cases:

- You are an employee and your annual income exceeds the threshold for compulsory GKV membership (Jahresarbeitsentgeltgrenze), i.e. €73,800 in 2025.

- If you are self-employed or a civil servant, you can choose private insurance directly, with no income requirements.

Back to public

Returning to the GKV is only possible if you lose the necessary conditions to remain privately insured, for example:

- Your gross salary falls back below the compulsory affiliation threshold (this threshold increases each year).

- You are unemployed and receive unemployment benefit (Arbeitslosengeld).

Typical example: during a Elternzeit (parental leave), if you reduce your professional activity to part-time (at least 1 month), your pay cut may mean a return to the public sector.

⚠️ Important: if you stop working altogether during the Elternzeit, you stay in the private sector!

Is it really better to go back to the public sector when you're having a baby?

Not always. There are several elements to analyze:

- Do you have to pay for health insurance while on parental leave?

Private: Yes, you must continue to pay your contribution.

Public: It depends: If you're not married, or if your spouse is in the private sector, you pay a contribution. If you are married and your spouse is in the public sector, you can be insured free of charge via his or her insurance (Familienversicherung).

It's one thing to have to pay contributions during parental leave when you could (in some cases) have avoided it by staying in the public sector. But parental leave only lasts a few months, whereas the child will have to be insured until he or she leaves home. So this is a very important point.

- What about the child's health insurance?

If you're not married, you can choose which parent insures the child. If your partner is in the public sector, the child can be insured free of charge with him or her. If you are married, the child is insured with the partner with the higher income.

If you have to insure your child privately, it will cost you ~€200 per month.

➔ Even when paying for the child, private insurance often remains more financially advantageous, while offering better benefits (without the need to take out a complementary health plan).

To remember:

Changing for the public may sound interesting on paper, but :

- You would lose your conditions of entry to the private sector (age and state of health at the time of initial enrolment).

- This could complicate a subsequent return to the private sector.

In a nutshell:

- If you are planning 4 or more children, the calculation clearly changes 🙂

- Otherwise, staying in the private sector is often more advantageous in the long term.

Conclusion: Make an informed choice... and don't let time decide for you

The choice between public (GKV) and private (PKV) health insurance is crucial: it influences not only your contributions and benefits today, but also your long-term situation. Many people stay with the public system by default, so as not to have to make a decision.

But it's better to make a well-considered decision based on the right information, rather than letting complexity or the fear of making a mistake dictate a default choice.

If you would like personalized support to analyze your situation and make the right choice, contact Expat Finance:

- We will carry out a study based on your current situation and consider the consequences for the future.

- We'll help you complete the necessary administrative procedures

- We'll help you take out private German insurance at the Caisse des Français de l'Étranger or a complementary one, depending on what's most attractive today and in the long term.